Last year, CIX Canadian Innovation Exchange announced technology startups for their 2022 program.

Companies are chosen for the program based on key factors including product offering, depth of management, market opportunity, and business model.

The list included d1g1t, an Enterprise Wealth Management Platform powered by institutional-grade analytics and risk management tools that enable firms to elevate quality of advice and value to clients.

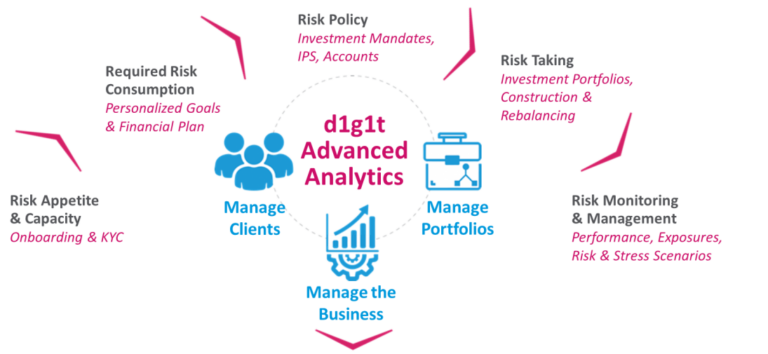

“We empower wealth management firms to transition into a new business model that is driven by technology and analytics, and provides a richer experience for their clients,” the company explains online. “For this purpose, we have built an innovative cloud-based technology platform, powered by advanced analytics, for financial advisers and their clients.”

d1g1t allows advisors to develop integrated investment advice for clients that is consistent across the wealth risk cycle. And through interactive portfolio tracking and automatic rebalancing capabilities, the platform ensures alignment across clients’ risk tolerance, goals, investment mandates, and actual portfolios for multiple accounts and legal entities, according to the firm.

The company was founded by Dan Rosen, chief executive; Philippe Rouanet, chief of operations; and Benoit Fleury, chief product officer.

The team has successfully continued the momentum of d1g1t momentum through to 2023: the company was this month recognized by Deloitte in its annual Technology Fast 50 program.

The rapidly rising fintech ranked 24th on the list, posting a three-year revenue growth of nearly 900%.

And it’s not d1g1t’s first rodeo on the Fast 50, either.

“We are truly delighted and honoured to be included in the Deloitte’s Technology Fast 50 program for a second year in a row,” stated Rosen.

“This recognition is further validation of our value proposition,” the CEO continued, “empowering wealth management firms with the technology they need to grow their businesses, streamline operations, and deepen the relationships with their clients.”

The Canadian fintech also recently raised a round of capital funding featuring MissionOG CI Financial, National Bank of Canada’s venture arm NA Ventures, Illuminate Financial, Purpose Financial, FigTree Financial, and CIBC Innovation Banking.

“The demands and requirements of both advisors and their end customers have become more complex, yet the solutions to address their needs have largely remained stagnant,” stated Andy Newcomb, Managing Partner at MissionOG and a d1g1t board member, in September. “In response, d1g1t offers a total solution that has proven its ability to service and delight some of the industry’s most demanding customers.”

“By providing us with a whole new set of capabilities to engage with our clients in real-time and elevate their experience, the d1g1t platform helps us accelerate our growth and establish ourselves as a leading wealth advisor in the region,” affirmed Danny Farmer, cofounder of FigTree Financial.

Farmer says this powerful technology is emerging at the “forefront of wealth management practice.”

Leave a Reply