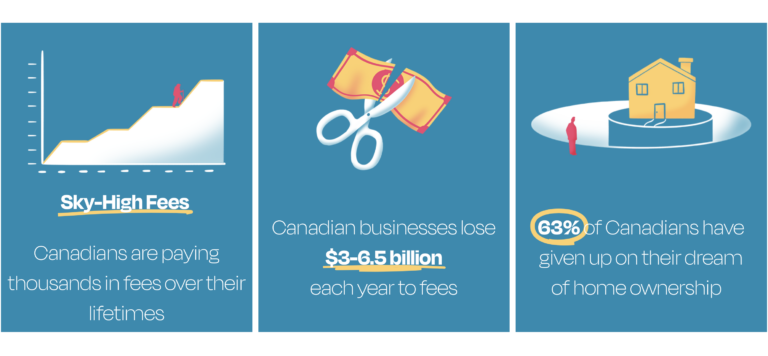

Canadian businesses lose several billion dollars per year to payment processing fees, according to a report from Payments Canada. And many Canadians pay more in fees than their bank accounts generate in savings, a RateHub survey discovered.

“Canadians are really feeling the pinch across a range of sectors, and the financial sector is one of them,” states Alex Vronces, Executive Director at Fintechs Canada.

For these reasons and more, a group of Canadian financial technology firms have banded together to launch a bold online campaign targeting the government’s lack of action around keeping the country’s banking infrastructure and innovation up-to-date.

“Choose More” is a “movement of Canadians who believe Canadians deserve more choice, more freedom, and more opportunity when it comes to their relationship with their personal finances, data, and economic future,” according to the campaign’s website.

The strongly toned campaign is being coordinated by Fintechs Canada, whose members include Wealthsimple, Borrowell, Flinks, Wise, EQ Bank, Nuvei, Xero Canada, and more.

They lament the fact that open banking is not yet available in Canada, “despite it being available in other countries like Australia and the UK.” Mexico, Brazil, and Argentina are other nations cited as being ahead of Canada on banking.

The government of Canada has established an advisory committee on open banking, the campaign admits, “but they have yet to deliver on an official set of rules and regulations to allow this model to fully and securely exist in Canada.”

The campaign argues that Canada’s payments system today “is not built to keep up with the innovation happening across the world, or with the expectations of consumers and businesses.”

“Payments modernization is about upgrading our outdated payment technology and laws to make sure they’re responsive to the needs of Canadians,” reads the Choose More website. “Canada’s slow uptake to modernize its payment system also runs the risk of stifling innovation, since companies may be pushed to leave Canada and take their business elsewhere.”

According to the campaign, open banking has the potential not just to modernize our finance sector and offer convenience to Canadians, but possibly even reduce the cost of living in Canada.

“Slow and inefficient backend systems can result in overdraft fees, late payment fees, and a reliance on payday lenders that charge high interest fees,” the fintechs suggest. “Payments modernization can reduce these costly delays through the implementation of instant payment systems.”

Participants in Canada’s open banking ecosystem are varied, from data providers and recipients to government bodies and end consumers.

“The challenge is to have all these participants work together to provide a seamless experience even though each participant has different abilities and drivers,” Saba Shariff, a senior executive at Symcor, noted in a recent interview with Fintech.ca.

Such complexity may be a factor contributing to Canada’s slowness in implementing infrastructure.

However, there is no excuse for being “one of the slowest countries in the Western world to implement open banking,” according to Michael Garrity, founder of Financeit, in a May interview with Fintech.ca.

“In the end, it is really not rocket science and there are plenty of effective, operational frameworks to borrow from,” he says.

Canadians, for their part, are barely aware of open banking as a concept. The Financial Consumer Agency of Canada found that only 9% of Canadians had heard of open banking.

Fintechs Canada was established in 2019.

Leave a Reply