Finofo announced this week pre-seed funding.

The Calgary-based financial technology startup wants to reduce the headache and complexity around foreign exchange rates for cross-border businesses.

Finofo raised capital after being conceived from “firsthand encounters with the challenges businesses face in financial operations,” according to the founders.

“Recognizing the limitations of existing solutions, we were inspired to develop a more efficient and effective platform to address these pain points,” they say.

The Canadian fintech drew investment from Motivate Venture Capital, SaaS Venture Capital, Desjardins Financial Holding, Sweet Spot Capital, and angels.

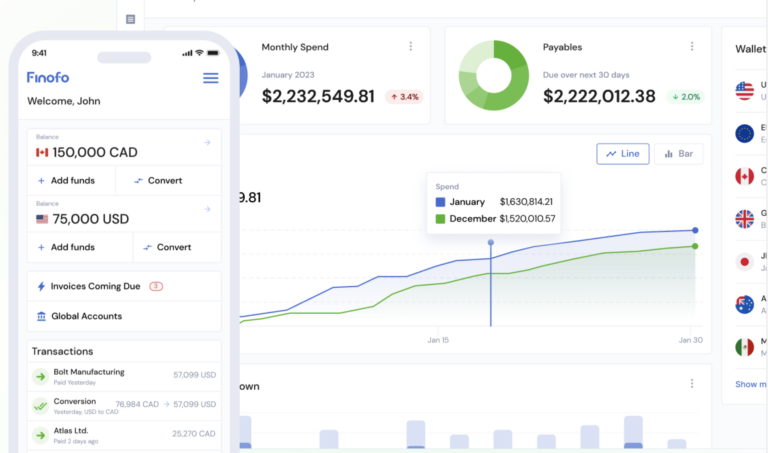

Alongside the funding, Finofo has officially launched its platform, which enables businesses to send and receive money globally, convert currencies, and automate accounts payables.

“We deeply believe in continual innovation, customer obsession, transparency, and meritocracy,” the startup says online. “Anchored by our principles, we focus on delivering outstanding experiences while transforming business finance and setting new industry standards.”

The FX-oriented platform will continue to develop with new features following the pre-seed capital. Indeed, Finofo wants to become a financial “super app” for business operations, according to cofounder Charles Maranda in an interview with TechCrunch.

Maranda’s mission is to “build the only financial platform businesses should ever need.”

“Business finance teams currently have to piece meal a solution for their diverse needs,” he laments. “Our goal is to exponentially improve how finance teams transact, plan, and strategize their financial operations by offering a unified and integrated platform.”

Leave a Reply