Generative AI continues to grab attention for its startling ability to replicate human-like intelligence and skills in a variety of ways.

A new report from a major titan in the fintech space explores this new technology’s implications for the future of commerce.

The latest edition of Mastercard Signals considers AI’s potential to strengthen customer engagement, create more efficient business operations, support software development, and more.

“Unlike other technologies that have seen hype cycles,” the report reads, “generative AI exhibits clear use cases, has led to the creation of robust solutions, and is developing swiftly.”

New opportunities “will continue to appear,” according to Signals. Over the several years, expect widespread integration of generative AI.

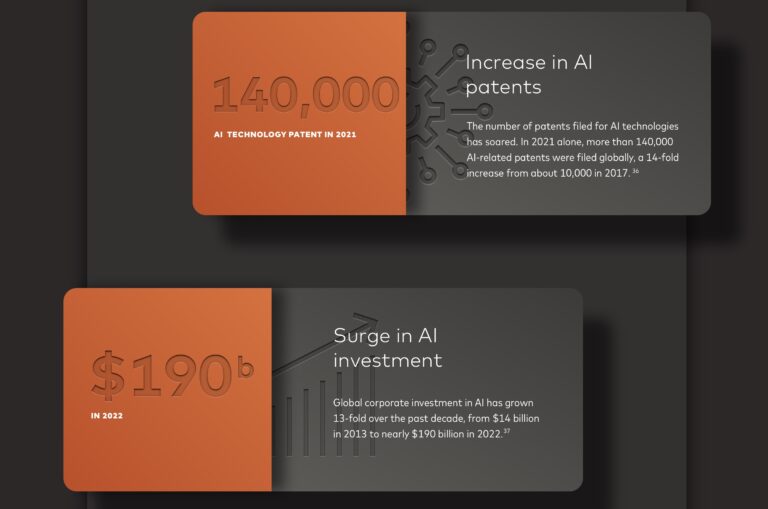

Patent applications involving AI have skyrocketed in the past decade, as has global corporate investment in the technology—up from $14 billion in 2013 to $190 billion last year.

“This technology is poised to be transformative across nearly every sector,” the report continues, including “large enterprises, small businesses, banking, retail and travel.”

The Next Economy

Mastercard alludes in Signals to the “Next Economy,” which is the corporation’s vision for a future of commerce “underpinned by innovations that will let us reimagine money and value exchange, promote intelligent experiences, and entrench principles of inclusion and sustainability into the way we develop products and services.”

Banks, merchants and digital players are poised to be at the forefront of this revolution, Mastercard says, putting to work emerging technologies such as tokenization, cloud computing and advanced networking.

A key inflection point of the Next Economy is underway: the democratization of AI. Today, more than 50% of companies are exploring how to employ AI to innovate, up from just 20% in 2017.

“An initial focus area for many is to seek ways to leverage the technology with human oversight to reduce risks while improving internal systems and operations,” Signals says.

Consumer and business demand for security, personalization, convenience, and automation will likely be focus areas for AI users, according to the report.

For example, financial institutions may leverage it for personalized banking services, fraud detection, and regulatory compliance. Retail and e-commerce companies can employ generative AI to optimize supply chains, bolster marketing efforts through hyper-personalization, improve measurement, and accelerate speed-to-market for new products and services.

Alongside AI, a fintech-fuelled digital transformation of critical infrastructure such as payments is laying the groundwork for the Next Economy.

Three-quarters of Canadians have used at least one emerging payment method in the last year, which includes cryptocurrency, digital cards, and “Buy Now, Pay Later” services. This figure is project to rise to 88% next year.

Leave a Reply