Navigating complex tax incentives can be a daunting task for businesses.

Boast AI wants to revolutionize the way companies maximize eligible incentives. The Toronto fintech’s modern approach, blending intelligent technology with expert services, is shaping a new era for research and development credits.

“In almost half a century there has been no considerable advancement in tax credit preparation and R&D intelligence,” Boast AI posits. “As a result, businesses are struggling to accelerate their innovation.”

In today’s fast-paced business world, companies that adopt innovation outpace competition by a whopping 260 percent, according to data from the fintech. By accessing the billions of dollars available in R&D tax credits and funding, companies hone insights and grow at an accelerated pace.

“Governments give away $20 billion in R&D tax credits each year,” the company says, “but applying has been difficult and slow. Not with Boast.”

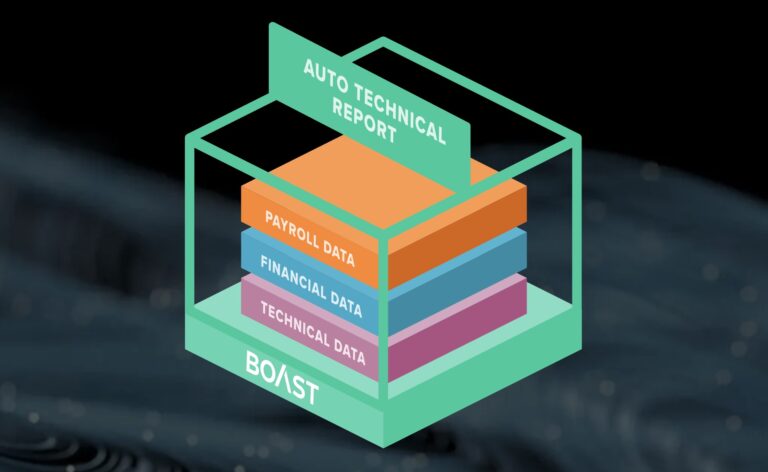

The cornerstone of Boast’s approach is its software, which integrates financial, engineering, and project data to optimize the accuracy and size of eligible tax incentives.

Boast prides itself on being a champion of claim quality, compliance, and audit readiness, while technical staff simplify perplexing processes surrounding R&D tax credits. Combining in-house experts with an artificial intelligence platform is one secret sauce to the startup’s success, according to chief executive officer Alok Tyagi.

“Boast makes real money for our customers by doing the hard work for them—we do this by taking something complex, and time-consuming, and making it easy,” he says. “As a result, customers get larger tax credit refunds, save fifty to a hundred hours of time, and they get more defensible claims and faster access to their tax credit funds.”

Boast AI found through a survey that 8% of respondents are not tracking the financial outcomes of their R&D in any meaningful way, and that 75% of R&D tracking conducted today “remains extremely manual.” Today, the company claims over a thousand satisfied clients and over $350 million in tax credit refunds distributed in just two years.

Building on this growth is the fintech’s latest platform upgrade, an AI-enabled universal data ingestion feature launched this week. By classifying relevant projects, this feature helps small and medium-sized enterprises access more tax credits that go unclaimed each year across North America, according to a recent statement from the firm.

“Our new feature overcomes the limitations of specific project management tools,” says Tygai. “Now, customers have the flexibility to use popular tools like Monday, Asana, and Google Sheets, while benefiting from the optimized efficiency provided by our AI-powered data classifier.”

It’s one more step toward helping customers to “use their R&D dollars better and innovate more,” according to the CEO.

“It is our mission,” he affirms.

Leave a Reply