Open banking could shape the future of banking in Canada, according to a recent statement from the Financial Consumer Agency of Canada.

But a new study reveals a lack of awareness and understanding of open banking among Canadians.

As part of its mandate, FCAC monitors and evaluates trends and emerging issues that affect financial consumers, such as open banking.

And according to the latest public opinion research conducted in partnership with Advanis, only 9% of Canadians have heard of open banking—and the understanding of those aware remains limited.

Open banking, defined as a framework that allows consumers and businesses to authorize third-party financial service providers to access their financial transaction data via secure online channels, is still a novel concept for many.

Open banking is not yet available in Canada, but many Canadians are already using fintech apps that use “screen scraping” to access financial data, which is different from open banking “because consumers must share their online banking username and password,” which may violate consumers’ electronic access agreements with their banks and expose them to security, privacy, and liability risks.

Despite government efforts to develop a made-in-Canada open banking system, the study indicates the road to acceptance may be more challenging than expected.

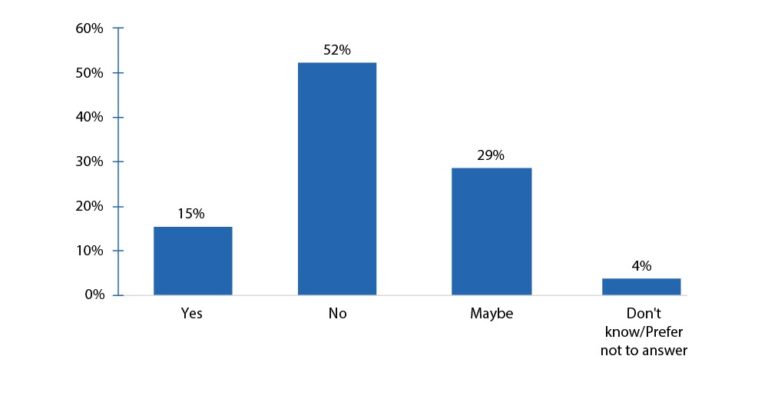

The report highlights a low inclination among Canadians to participate in an open banking system. Over half of the participants (52%) declared they would not take part, whilst about a third (29%) remained undecided, indicating the need for more comprehensive information about open banking.

When it comes to consumer protection expectations, Canadians value a broad range of safeguards. The report indicates that such measures and consumers’ awareness of them could influence the adoption of open banking.

The most sought-after protection measure is “full protection from any losses,” selected by 70% of respondents, followed by the “ability to revoke consent at any time” and “requirements to report data breaches exposing consumer data,” each chosen by 63%.

“As Canada moves forward with introducing a framework for open banking, it is essential that the rights and interests of Canadians are protected,” affirms Judith Robertson, Commissioner, Financial Consumer Agency of Canada. “For Canadians to realize the benefits of open banking, strong and consistent protections will be key.”

The report also found that Canadians blindly expect similar levels of protection across traditional banking and fintech services. The report found 80% of Canadians either wrongly believed or were unsure whether the protection offered by fintech companies equates to that of banks; only 18% of respondents knew that protections are different when using services offered by fintechs versus banks.

As open banking evolves in Canada, ensuring consumers’ rights and protections may be key to encouraging wider participation and shaping the success of this initiative.

FCAC has provided recommendations to the Government’s Advisory Committee on Open Banking. One of FCAC’s key recommendations is that consumers should benefit from strong and consistent consumer protections and market conduct standards. These include language that is clear, simple and not misleading, no coercion, express consent, and a robust complaints-handling system.

Protections should also address the privacy and security of Canadians’ financial data, the organization added.

This year’s Open Banking Expo Canada in Toronto on June 15 will bring together more than 500 open banking, open finance and open payments executives from the financial services and fintech ecosystem at the Metro Toronto Convention Centre.

“The announcement of Canada’s new open banking framework is the first step in the evolution of Canada’s financial system, which will transform the way Canadian businesses and consumers securely manage their data and finances,” stated Darrell MacMullin, senior vice president, products and platforms of Mastercard Canada, in May.

Leave a Reply