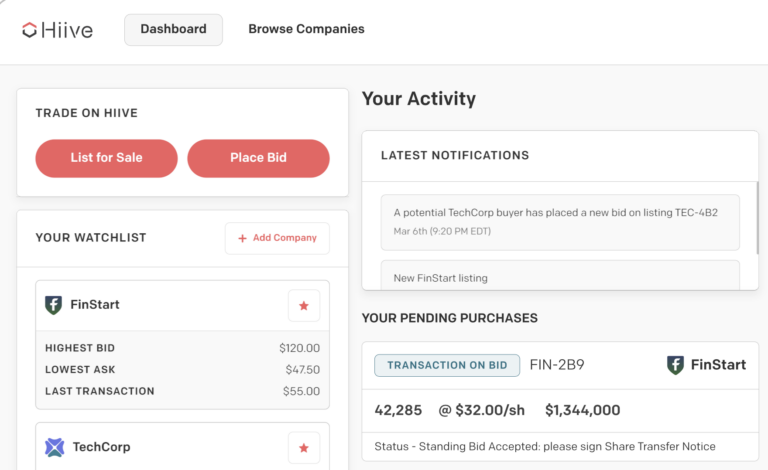

Hiive operates an online marketplace for private company stocks—essentially, a meeting place for buyers and sellers of shares in privately held companies, typically those backed by venture capital.

Accredited investors and funds can place an order to buy or sell shares directly from other parties without needing a live broker because Hiive automates and centralizes the processes usually carried out in traditional secondary markets.

Emerging as a global marketplace for buyers and sellers of stakes in pre-IPO companies, Hiive announced this week that it has now been approved to deal with sellers and investors in its home country.

“We’re proud to finally be able to offer the platform to our fellow Canadians,” said Sim Desai, CEO of Vancouver-born Hiive.

Hiive was created in Canada but has focused on the United States market, where the trading platform is regulated by FINRA and the SEC, since launching in 2021.

“We’ve gotten a tremendous reception in the US since launching our platform last July and both user activity and transactions on platform have been rising exponentially,” said Desai, a Vancouverite. “Our vision was to create a transparent, centralized, and automated platform.”

Hiive will now allow Canadian venture capitalists, investment funds, family offices, and ultra-high-net-worth individuals to better access pre-IPO markets.

“Demand for access to investments in these generation-defining startups has been on the rise, particularly amongst investors seeking higher return alternatives to public equities and bonds,” stated Desai.

For shareholders, Hiive offers fixed and competitive prices and allows for anonymity until a sale is made.

For issuers, Hiive offers a simplified cap table (a record of all the major owners of a company), share transfers, and the ability to maintain control of a table without fees, commitments, or financial disclosures.

Desai said that it’s also an opportunity for Canadians looking to sell shares of highly valued technology startups to entertain offers from US, Canadian, and global buyers.

“Thousands of Canadians are employed by US, European, and Canadian tech companies that are listed on our platform,” Desai said. “With the IPO window firmly shut, this may be one of their only paths to cashing-out in the foreseeable future.”

Leave a Reply