Plaid launched in Canada in 2018 to enable account connectivity for thousands of fintechs and help increase financial access for millions of Canadians.

Since then, they’ve worked with top Canadian companies like Wealthsimple, Shopify, and Wave.

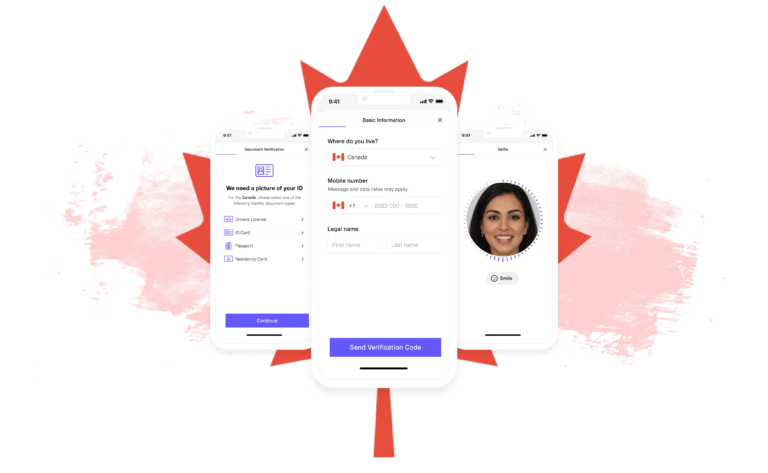

But onboarding a new user is more than just account connectivity. It requires navigating complex KYC requirements, verifying a user’s identity, and combating fraud.

To solve that issue Plaid has announced it will now enable its identity verification and KYC solutions in Canada, to help users comply with Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) requirements.

Plaid’s head of identity, Alain Meier, explained in a blog post that through a single Plaid integration, Canadian companies will be able to verify the identities of users from more than 200 countries.

With English and Canadian French support, Plaid IDV, will allow customers to comply with multiple FINTRAC verification methods, such as direct integration with credit reporting agencies in line with the supervisor’s credit file and dual-process requirements.

Interested in learning more about Plaid’s solution for Canadian businesses? Join their Tech Talk on February 28th to learn more.

Leave a Reply