When we consider the technological transformation of the financial industry, it shares many parallels with other broad sectors facing similar digital disruption: lean startups sparking fires under stodgy incumbents; innovation altering markets in both predictable and unpredictable ways; everything-as-a-service.

One increasingly commonplace technology, which seems to mesh particularly well with today’s wave of fintech products and services, is artificial intelligence.

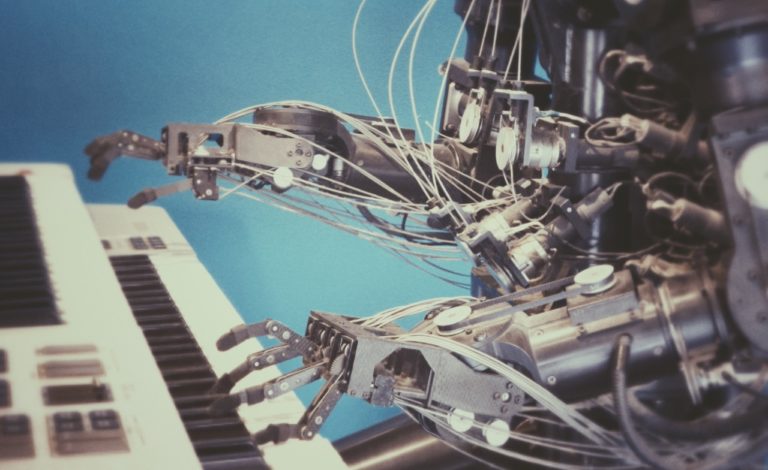

Many still think of human-like robots marching about when they hear the term “AI.” But the fact is, the technology is actually quite prevalent in day-to-day life.

However, because AI is not (yet) presenting itself often in the form of a humanoid, most remain unaware that it’s already everywhere.

Financial technology is certainly no exception.

Indeed, fintechs across Canada are actively leveraging all manner of AI to power their products—and it seems to be working out well for them so far, even when end users aren’t necessarily cognizant of what is powering today’s instant and seamless digital products and services.

Below, we capture just a small handful of the many Canadian fintechs tapping into the power of modern AI, and how the technology fuels business and reaches customers.

RBC, OJO Labs

In 2018, Texas-based real estate technology platform OJO Labs tested the waters of the Canadian market through a partnership with the Royal Bank of Canada’s venture arm. Then in 2021, RBCx supported the pilot launch of OJO Canada.

OJO Canada guides consumers through a digital-forward home-buying journey by providing a customized home search experience, on-demand access to a network of industry experts, and the support of financial resources. Much of the platform’s technology is powered by AI algorithms.

The Royal Bank recently acquired OJO Canada to further enable “RBC’s commitment to support Canadians at every stage in their home buying journey by offering intuitive, digitally-enabled and insights-driven experiences and resources to help them make one of the most important decisions of their lives.”

“OJO Canada offers a powerful real estate platform that serves as a comprehensive one-stop hub for Canadian home buyers who are looking for a simpler, integrated experience in this fragmented market,” says Sid Paquette, Head of RBCx, which fused with RBC Ventures last year. “We remain focused on deepening our relationship with Canadian home buyers and real estate industry professionals, and delivering value-added experiences that eliminate pain points across their complete home-buying journey.”

So far, the platform has seen “consistent growth and overall performance in the Canadian market.”

Over the past few years, “OJO Canada has grown to become a valuable resource for Canadian home buyers and sellers,” according to Karen Starns, CEO of OJO Canada. “Canadians have aspirations to fulfill their home ownership ambitions—Now more than ever, consumers need a trusted ally to guide them through the home buying and selling journey.”

MinervaAI, Binance

Leading blockchain and cryptocurrency infrastructure provider Binance Canada last year partnered with Ontario-born MinervaAI—a technology provider for the detection and investigation of financial crimes—to boost compliance efforts in Canada.

“We are so excited to partner with Binance Canada making crypto safer and more accessible for all of their customers, while also making AI-driven AML compliance efficient, effective and affordable for our own customers,” stated Jennifer Arnold, CEO and cofounder of Toronto’s MinervaAI, in September.

As part of the partnership, Binance Canada utilized Minerva’s artificial intelligence tools and risk-screening capabilities to enhance their know-your-customer and anti-money laundering capabilities.

MinervaAI makes anti-money laundering risk assessment fast by bringing information and insight into one platform. Using sophisticated AI models to identify and predict those who pose financial crime risk, the Canadian startup’s tech is 99% accurate even when executing in real time.

“These tools already meet or surpass the tools that are commonly used in traditional financial institutions, and we will utilize Minerva’s state-of-the-art technology to further enhance the strength of our KYC process,” stated Binance’s Chief Anti-Money Laundering Officer, James Moore.

Gigamatic, IBM, MIT

Using technology from IBM, Gigamatic leverages Blockchain and Artificial Intelligence to help people self-manage administrative tasks such as banking, health insurance, and taxes.

For example: using machine learning, the Toronto fintech startup recommends financial and health insurance specially tailored for each user.

“This allows for a more competitive environment of rates from service providers, and also offers new products from fintech and insurtech companies that offer unbundled products for lending and insurance,” the Canadian company says.

Gigamatic was accepted into MIT’s CSAIL startup alliance in the Computer Science and Artificial Intelligence Laboratory in Cambridge, Massachusetts.

As a result of their alliance with MIT, Gigamatic will receive mentorship and guidance from PhDs about technology and business strategy.

“We are extremely humbled to be working with such a renowned institution, and are looking forward to collaborating with such a talented group,” the startup tweeted.

Gigamatic will also work directly with MIT students who will recommend best practices and help implement solutions.

“Our purpose is to serve the employee workforce and give them tools to make their financial and physical health care decisions easier to manage,” affirms the company. “Our goal is to transform the way that people balance their financial and health services—we believe that companies should start seeing their employee workforce as humans, where one person’s rights are not more important than another.”

Levr.ai

Vancouver startup Levr.ai recently secured $1 million to transform the way businesses access and manage loans.

The pre-seed funding round was co-led by Sprout.vc and MAVAN Capital Partners and included venture and investors Weave VC, AC100 VC, and Red Thread Ventures.

Co-founded by Kaylan Pepin and Roman Hartmann, Levr.ai makes the process of finding, applying for, and managing business loans easier.

To accomplish this, the BC fintech uses accounting and banking APIs to accelerate the process of looking for a loan, applying for a loan, and managing existing loans.

“Over my career, I‘ve seen many qualified businesses struggle to get financing,” stated Pepin, who is no stranger to the financial services industry after stints with RBC Royal Bank, Canadian Imperial Bank of Commerce, and the Business Development Bank of Canada.

“Even worse than the complex loan application process is the lack of software tools available to manage active business loans,” said the startup CEO. “We’re building Levr.ai to solve these issues.”

CTO Hartmann’s career has been heavily focused on data, AI, and machine learning. He’s passionate about empowering Levr.ai’s customers through access to ML-driven insights of their own data.

MindBridge

Ottawa’s MindBridge Analytics uses artificial intelligence to discover risk in finance.

“Having the ability to quickly identify risk within financial data sets is providing greater opportunities for businesses to make better decisions and react in a more accurate and agile manner,” said Robin Grosset, CTO of MindBridge, in June.

The cloud-first AI financial risk discovery and anomaly detection software startup says that new financial data workflow capabilities show how this release makes integrating MindBridge into an organization’s approach easier.

“MindBridge helps ensure that organizations conduct their financial transactions in an ethical and transparent manner by surfacing potential financial irregularities and thereby reducing risk,” said Grosset.

Grosset called it “another strong release introducing several significant product enhancements within our platform to help organizations continue to benefit from MindBridge and our next-gen capabilities.”

MindBridge was founded in Ottawa in 2015.

QuadFi

QuadFi last year unveiled a “breakthrough” in its product offering.

Traditionally, information on financial histories have been limited within countries, with FICO scores as the industry standard to assess one’s credit risk rating. Now the Toronto fintech is using artificial intelligence to predict an applicant’s future potential rather than their past history.

“The customers we serve are young, ambitious, and well-educated; they immigrate from their home countries to build better lives and explore their full potential in a new one,” explains Dr. Manny Nikjoo, CEO of QuadFi.

Canada has one of the highest per-capita immigration rates in the world, he notes.

“Here in Canada, we welcome 400,000 new immigrants every year,” says Nikjoo, who he believes “deserve access to financial products from day one.”

The company wants QuadFi’s service offering to feel truly borderless.

“As a Certified B Corporation, we are committed to leveraging our engineering and technical expertise to provide a positive social impact,” said Nikjoo. “We’re building a broader foundation to support a full range of financial products designed by immigrants, for immigrants.”

The entrepreneur added that all of this “is even more important given today’s environment where we’re seeing reduced credit access and soaring borrowing costs.”

The Toronto fintech has raised a large round of capital to fuel growth.

Leave a Reply