Last year, ZayZoon participated in Montreal’s Financial Health Lab, which assists fintech startups that use technology to help improve the financial lives of Canadians by making financial products and services more affordable.

The Calgary-based fintech then maintained momentum with $25 million in new financing over the summer.

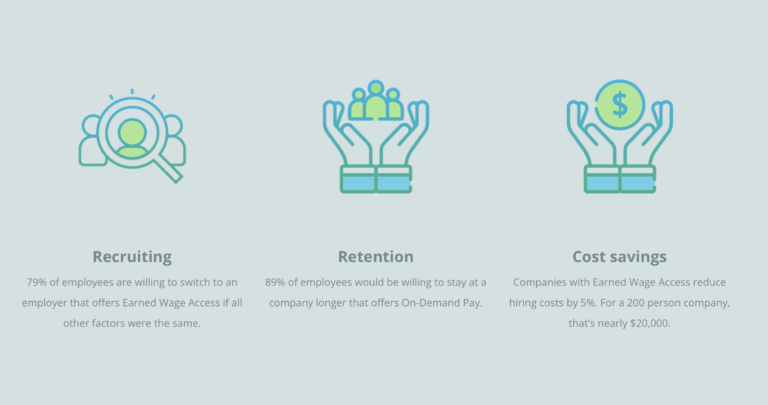

The ZayZoon platform allows employees to instantly access earned wages on-demand with more than 3,000 businesses, including McDonald’s and Burger King, who leverage the Alberta-born tech to improve employee recruitment, retention, and workplace productivity.

Backed by Carpae Investments, Alpenglow Capital, and many more, ZayZoon delivers a core product known as Wages On-Demand, which gives employees access to wages that they have already earned but would otherwise have to wait until their next payday to receive.

The startup believes that, with Canadian consumer debt now north of $2 trillion, its service is essential.

“Payroll has been the same for the better part of the century, but the needs of employees have changed,” cofounder Darcy Tuer told Business in Calgary. “ZayZoon gives employees access to the money they have already earned. We are not a lending company. We provide liquidity on our clients’ earned wages.”

Working Canadians are beginning to experience “the first drops of a financial stress storm that appears to be gaining in intensity,” a report based on the National Payroll Institute’s annual survey of working Canadians warned last year.

According to the report, Canadians living paycheque-to-paycheque increased 26% from 2022 to 2021.

The ZayZoon approach is “unlike anything seen in the financial market before,” according to Alberta institution ATB. It observes that the Calgary startup charges nothing extra beyond its flat fee of $5, and the platform is free for employers to use.

“While the growth of the coping and stressed clusters shows that more Canadians are struggling financially as we emerge from the pandemic economy, the data indicates that things are likely to become even more difficult for more people in the near future,” Peter Tzanetakis, President of the National Payroll Institute, stated in September. “With rising interest rates and persistent inflation still an issue, it’s likely that this trend will continue.”

Might some working Canadians be so financially desperate as to abuse a system designed to help them out?

“We have procedures in place to prevent people from winding up in predatory cycles where their paycheck is gone before it comes in,” Tuer clarified to BIC. “For example, clients can access only 50 per cent of earned wages before payday.”

According to the CEO, a “vast majority of our clients are using ZayZoon to cover essential purchases.”

ZayZoon announced this month that it is now working with ATB Financial, the company’s initial financial partner for Wages On-Demand. The Edmonton-based Crown corporation “took a keen interest” in the business, noted Tuer. “They liked that we are a local Alberta company solving problems across North America, and … provided us with the capital pool we needed.”

The startup has experienced double-digit month-over-month growth for two years now, and Tuer says to “expect that to continue through 2023.”

“We are extremely excited to see the tremendous level of interest and support for this important offering for both employers and employees,” cofounder Jamie Ha stated last year. “We are positioned to bring ZayZoon’s Wages On-Demand service to millions of people across America, especially during a phase when hardworking employees need it the most.”

Incredibly exciting to see the startups we have worked with featured. Just a small correction : ZayZoon is an alumni of Fintech Cadence’s Innovate Financial Health Lab, however they were part of our inaugural cohort back in 2020 rather than last year’s cohort.

Tate, ZayZoon’s founder, has since come back to join us as a coach and mentor for our 2022 cohort. It’s amazing to see the success they have had! We can’t wait to watch them keep growing.