I wear a fitness tracker, wield a tablet, and invest from my phone. Pretty standard stuff, right?

On the whole, I consider myself to be rarely at the forefront of cutting-edge technology. Very few things do I “early adopt.” I know this and I am okay with it.

Yet even as a relative techno-layman, I find myself well ahead of the curve in Canada.

What do I mean? Outside of any given “tech bubble,” the typical Canadian is more of a techno-Luddite.

Your tech bubble may be small, such as the combination of a few close friends and some company co-workers. Or, if you live in a city like Vancouver or Toronto, that bubble might dome the whole greater metropolis area.

In that reality, it becomes easy to think everyone wears a fitness tracker, wields a tablet, and invests from their phone.

However, it is not so. Not even close.

While I claim my ownership stake of commercial real estate investments through all-digital platforms like Addy, the vast majority of Canadians don’t even know the startup exists. Such are the terms and conditions for fledging fintechs looking to compete with ancient incumbents, whose long-established stranglehold of the national market is finally loosening but remains strong.

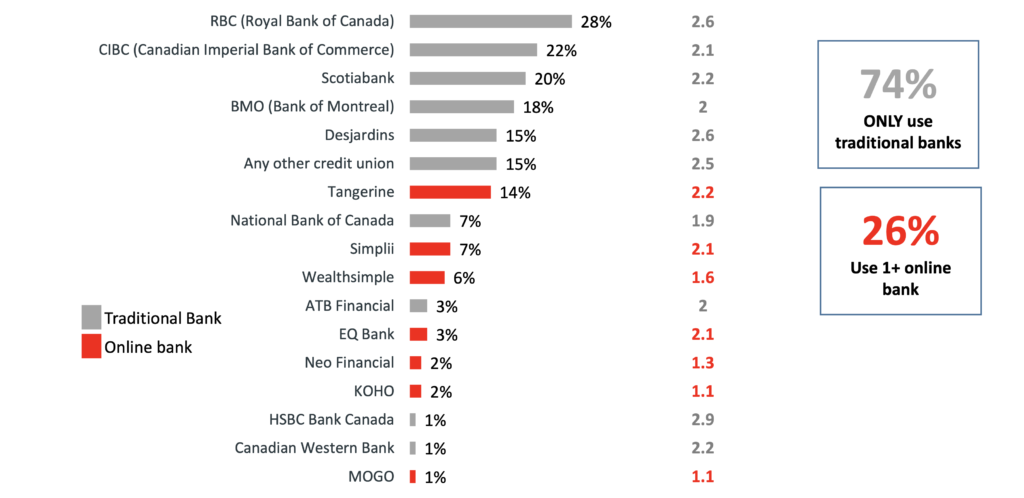

“Traditional banks still dominate the Canadian market, with usage being much higher compared to online banks,” reads a recent report from Leger’s Tech and Innovation series, which explores Canadians’ perspectives on fintech. 74% of Canadians only use traditional banks, while just one-quarter (26%) use one or more online bank, according to Leger.

These figures blow my mind.

I adopted “online banking” more than a decade ago through Tangerine, back when it was the independent ING Direct. The convenience of online made sense. But I would have expected such numbers in those days because online banking was newer and limited in options compared to physical banks.

Now, online banking easily competes head-to-head with traditional banking—in products and features, in customer experience, and in competition. But not in awareness.

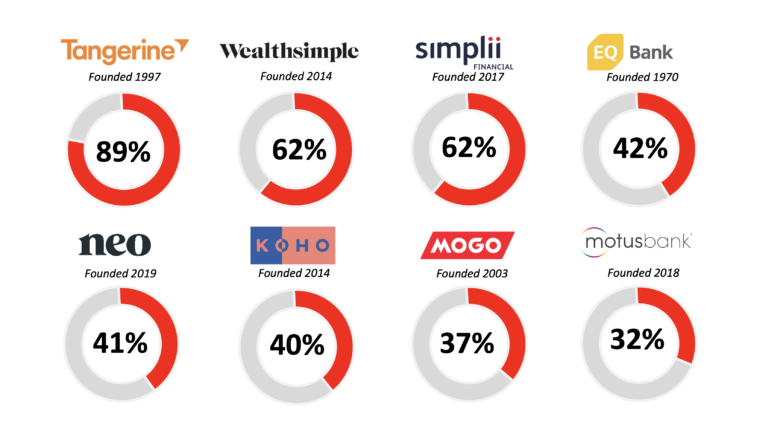

The aforementioned Tangerine, founded in 1997, is an exception with strong awareness in Canada; 89% of Canadians now know the brand and 14% use it. What about more recent additions to the fintech scene, though?

- 62% of Canadians are aware of Toronto’s Wealthsimple, founded in 2017.

- 40% know Koho, launched in 2014.

- 42% are aware of Calgary’s Neo Financial, founded in 2019.

- 32% have heard of Motusbank, launched in 2018.

“Online banks are not yet universally known among Canadians, with awareness levels ranging from 32% to 89%,” states the report, which was published from Leger’s Alberta office.

The Royal Bank of Canada, in contrast, is far older than all of these banks combined. Employing many tens of thousands and serving many millions of clients, one would be hard-pressed to find a Canadian who could not identify this financial titan.

For a fintech startup, it’s like battling a mythical creature at this point.

Of those aware of online banks, trust is reasonably high—either comparable or slightly lower levels of trust vs. banks in Canada as a whole, says Leger.

However, when it comes to shopping for their next banking product or service, just 40% of Canadians will consider online banks.

Those willing to consider fintechs skew young, male, educated, and with higher income. According to Leger, these early adopters value minimal fees, user-intuitive interfaces, and the ability to manage entire portfolios online.

Meanwhile, Canadians who only bank with traditional banks place more importance on customer service, advice from a real person, and having physical locations.

To surmount such hurdles, Leger believes online banks will “need to differentiate beyond offering new technologies, since most trust traditional banks to deliver on these.”

“A strong majority trust traditional banks to adopt the newest technologies and also want their bank to adopt the newest technologies,” the report states.

82% of Canadians trust traditional banks to adopt the latest tech, while just 58% trust that same (or better) technology from an emerging startup.

“This suggests traditional banks will continue to pose tough competition to online banks, and that online banks will need to differentiate beyond their technology,” says Leger.

I strongly agree that there is “an opportunity to educate Canadians about fintech as knowledge levels of financial technologies are low.”

It’s up to satisfied users to spread word to family and friends, and it’s on banking challengers across the country to push the boundaries of fintech innovation in Canada.

Leave a Reply