The Covid-19 pandemic changed a lot of things about the way we live including how consumers treat their personal finances. To help Canadians face the economic downturn back in 2020, Hardbacon was transformed into a free app, and quickly evolved to include planning and budgeting features, as well as financial product comparison tools.

More than 230,000 monthly active users later, Hardbacon is proudly helping Canadians on the road to financial independence. Most recently, it closed an equity crowdfunding round on FrontFundr bringing Hardbacon’s total financing to more than $3.3 million since its founding.

More than 230,000 monthly active users later, Hardbacon is proudly helping Canadians on the road to financial independence. Most recently, it closed an equity crowdfunding round on FrontFundr bringing Hardbacon’s total financing to more than $3.3 million since its founding.

The money from this round will be used to fuel company growth, as Hardbacon aims to become the go-to tool that everyone turns to, whenever they make a financial decision, whether it’s for budgeting, planning, investment tracking or comparing financial products.

Next, Hardbacon has announced its intention to go public in 2023. Fintech.ca sat down with Hardbacon’s CEO Julien Brault to learn more about Hardbacon’s growth, trends in the personal finance industry, and the future.

How has the personal finance industry evolved since the Covid-19 pandemic?

The pandemic was a catalyst for people to think about their personal finances. First, there was the economic uncertainty and the lay-offs that reminded people about the importance of savings. Then, there was a bull market, combined with a remote workforce, which led many Millennials and Gen Z to start investing through free stock and crypto trading apps. Lastly, many new personal finance influencers were born on YouTube and TikTok.

While some people made mistakes, overall these trends led many people to develop an interest in personal finance and I think that’s for the better. Looking ahead, with both the crypto market and the stock market contracting, it’s going to be easier for people to keep learning and growing.

How is Hardbacon innovating the personal finance landscape?

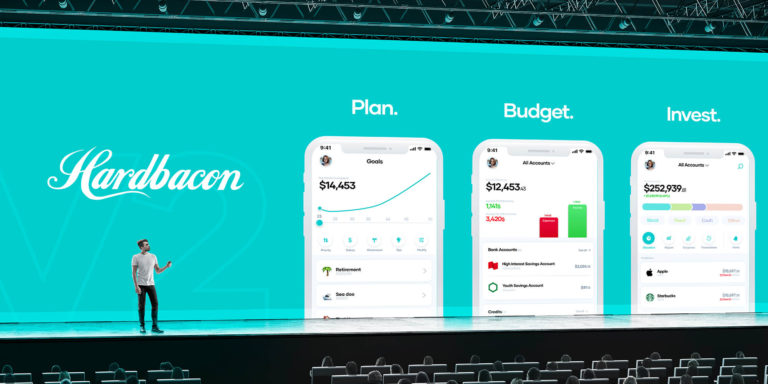

Hardbacon is the only rate comparison website in Canada that is able to sync with user’s bank accounts and credit cards, and to make personalized financial product recommendations based on their behaviour and needs. Our app also helps our users budget and plan, so it’s a complete toolbox to manage their personal finances.

Furthermore, another thing we do differently is make sure our comparison tools include all financial products available, and not only the ones for which we collect a fee for referrals. This way Canadians can do all their financial product shopping in one spot, on Hardbacon.

Since your app already connects to bank accounts, do you have something to gain from the adoption of Open Banking in Canada that was announced for 2023?

I’m sceptical about the 2023 timeline, but I sure hope it will be implemented as soon as possible. Currently, Hardbacon relies on third parties that use a technology called screen scraping to fetch account data. While it’s 100% secure, this technology has a few disadvantages, including a relatively high failure rate.

As a matter of fact, 80% of customer support tickets filed on the Hardbacon app are related to an account that failed to sync with Hardbacon. We expect the open banking regulations will reduce the syncing failure rate to 0 so, yes, it’s a big deal for us and we’re very happy that the federal government will adopt open banking.

Hardbacon recently established relationships with home insurance provider Square One, as well as with Securiglobe. How do you provide value to these institutions?

We are selling most of our home insurance leads outside of Quebec to Square One and all our travel insurance leads to Securiglobe, so ultimately we help them acquire customers. On the other hand, we picked those partners because they allow our users to see the pricing of many different policies before they make a choice. In both cases, our users are winning because they can compare pricing and features from the comfort of their home without the pressure of a salesperson, while our partners are winning as they get to acquire new clients.

Hardbacon just announced a $820,000 equity crowdfunding close. Can you share a bit more about how the proceeds of this round will be used to fuel company growth?

Part of it will be used to keep building our technology. In particular, we’re really excited about adding customer reviews that will help Canadians make more informed decisions. Each financial product that we compare on Hardbacon will have a dedicated web page. Some information will be provided by our editorial team, but what makes this feature really unique is that users will be able to rate any product and leave a review. Likewise, most of the proceeds will be invested in content. We have already published more than 2000 articles and guides about personal finance, and we think there are still thousands of financial topics that we did not yet cover.

What are you most excited about for Hardbacon in 2023?

Besides open banking, there are two segments that we are really bullish on. The first one is our business section, which we launched to help small business owners make better financial decisions. Like consumers, we can help small business owners choose a business credit card, a business bank account or even an accounting software. The other segment that I’m excited about is insurance, including car insurance, home insurance and life insurance, to name a few. Even if there are other rate comparison websites that focus on insurance, they are not as transparent. Hardbacon makes insurance policy shopping a much better experience by helping Canadians compare more options.

Are there any emerging trends in the finance world that consumers should look out for?

I think one of the big trends that we’ve seen in the past few years is one where access is going up and fees are going down, which is mostly a good thing, but not always. In the brokerage industry, we’ve seen trading fees go from $25 to zero, and the minimum investment to open a brokerage account go from $5,000 to zero. And now, some players are offering fractional shares, so you can invest as little as $1.

All of this is great, but on the flip side, we’ve seen small investors make really bad decisions over the past few years. In fact, $0 trading brokerage apps tend to offer less data and less support to people that would probably need it the most. It’s the same story with BNPL loans. While there are zero interest loans and they are easier to get approved compared to traditional loans or even credit cards, they can easily be abused by people who, in some cases, should actually not have access to credit. I still think decreasing fees and increasing access is a good thing, but those innovations should be accompanied with increased financial literacy.

Where do you see Hardbacon in the next 5 years?

It may take more than 5 years to get there, but I would like Hardbacon to be a global fintech company helping people all over the world to make better financial decisions. We’ll start in the countries that have embraced open banking, such as Brazil, Mexico, Spain, France, Australia and the United Kingdom. But I believe most countries will adopt some form of open banking, so hopefully, the list will be even bigger.

Hardbacon will offer even more data to its users, such as their credit score, and tax information. We might also offer our own cash back program, allowing users to accumulate points by signing up for a new financial product or by shopping through our app. But more importantly, we’ll continue to be a financial empowerment tool that helps the little guy feel less vulnerable in front of large financial institutions. We’re busy at Hardbacon!

Leave a Reply