Last summer Fintech.ca reported that crypto asset trading platform Bitvo was being acquired by FTX, the world’s 5th largest crypto exchange.

At the time FTX CEO Sam Bankman-Fried (known as SBF) said, “We are delighted to enter the Canadian marketplace and continue to expand FTX’s global reach. Our expansion into Canada is another step in proactively working with cryptocurrency regulators in different geographies across the globe.”

It turns out SBF wasn’t as proactive with his regulatory work as he claimed and Calgary-headquartered Bitvo issued a press release last week distancing itself from its acquirer.

Bitvo updated the market on the potential acquisition, noting that the transaction has not closed and Bitvo remains independent from the FTX group of companies with no material exposure to them.

So what happened to FTX?

Earlier this month crypto publication CoinDesk released a bombshell report that called into question FTX’s liquidity and the health of SBF’s other main business, a hedge fund called Alameda Research.

Just days later, things got worse when CZ Zhao, the CEO of Binance — arguably FTX’s chief rival — decided to liquidate roughly $530 million-worth of FTT, a utility token issued by FTX.

Customers also raced to pull out, and FTX saw an estimated $6 billion in withdrawals over the course of 72 hours, which it struggled to fulfill.

The value of FTT plunged 32%, but rallied once again with CBF’s surprise announcement on November 8th that Binance would buy FTX, effectively bailing it out.

Unfortunately the next day Binance announced it was walking away from the deal, citing findings during due diligence, as well as reports of mishandled customer funds and the possibility of a federal investigation.

FTX, the hedge fund Alameda Research, and dozens of other affiliated companies filed a bankruptcy petition in Delaware on November 11th.

Bitvo CEO and president Pamela Draper told the Calgary Herald it is unclear how FTX filing for bankruptcy will affect the acquisition, but the fall of FTX was a surprise.

“We were absolutely shocked,” Draper said. “I think every player in the industry and people who have been following the FTX story around the globe were surprised, and we were no different in that regard.”

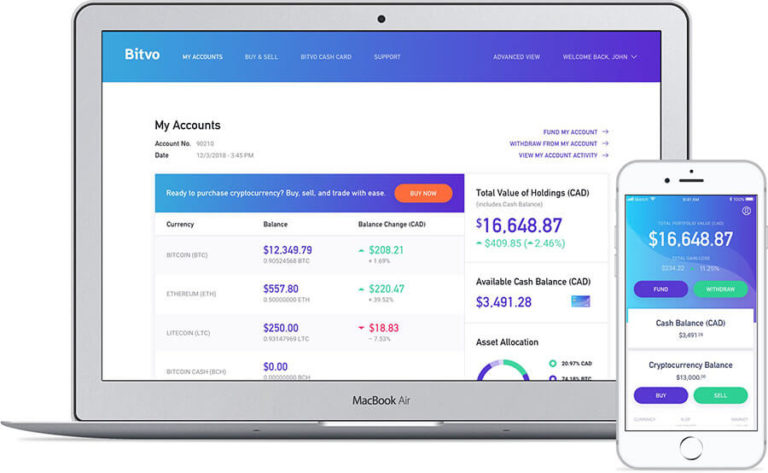

It appears Bitvo dodged a bullet on the uncompleted acquisition and is ensuring their customers that their funds are secure and that trading operations as well as withdrawals and deposits have and will continue seamlessly.

Bitvo is in compliance with regulations, including holding more than 90 per cent of investments in cold storage, preventing hacking and ensuring customer access to those investments.

Leave a Reply