Calgary’s Tetra Trust announced today that they have partnered with Coinsquare to provide their 500,000+ users with safe and secure custody services for their crypto assets.

CCML, a wholly owned subsidiary of Coinsquare, was recently approved by IIROC for dealer registration and IIROC membership, making them the first crypto-only, IIROC registered investment dealer in Canada.

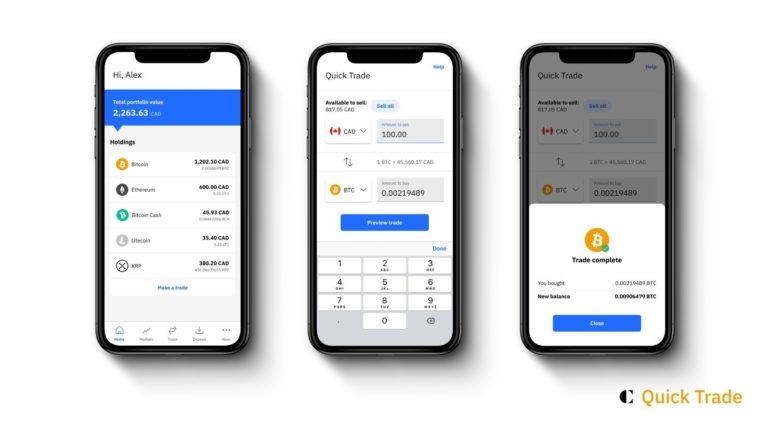

Coinsquare’s qualification for IIROC membership included the need for their custody partners to be regulated and insured, as custody is essential to a trusted crypto trading platform. Enter Tetra Trust.

Tetra Trust is the first and only trust company licensed to custody digital assets in Canada.

“The new standards for our crypto trading platform mean individuals investing in crypto today in Canada have greater safeguards than they would otherwise have with investing in crypto on their own. We are pleased to have a custody partner like Tetra which is fully aligned with supporting the objectives of Coinsquare,” said Coinsquare CEO Martin Piszel.

With billions of dollars worth of Canadian crypto sitting with U.S. custodians because of the historic lack of adequate Canadian options, Tetra Trust is looking to grow and wants to service crypto trading platforms like Coinsquare, one of the larger platforms in Canada which recently acquired Coinsmart.

“Tetra’s role is vital in ensuring that clients’ assets are kept safe, secure and available to them at all times,” said Didier Lavallée, CEO of Tetra Trust. “Our custody model supports CCML as we enable investors to retain ownership of their assets under Canadian jurisdiction by a regulated trust company.”

The inclusion of Tetra as a custody partner for CCML is also further legitimizing the digital asset space in Canada as traditionally digital assets have been managed by U.S. or international custodians due to a lack of adequate local options.

Tetra Trust has been building its reputation in the Canadian market and recently announced a partnership to custody 3iQ’s various exchange-traded funds which represent approximately $700 million in assets under management.

The company also provides custody services to Accelerate Financial’s NFT Fund, which was Canada’s first Web3 investment vehicle when it was announced earlier this year.

Leave a Reply