A New Brunswick financial technology startup has raised a seed round.

Following a stint at the iconic Y Combinator accelerator, Fredericton-based fintech Passiv announced this week it has secured a $2.2 million USD seed round.

Y Combinator invested in the company alongside Mistral Venture Partners, Uncorrelated Ventures, New Brunswick Innovation Foundation, East Valley Ventures, and several angel investors.

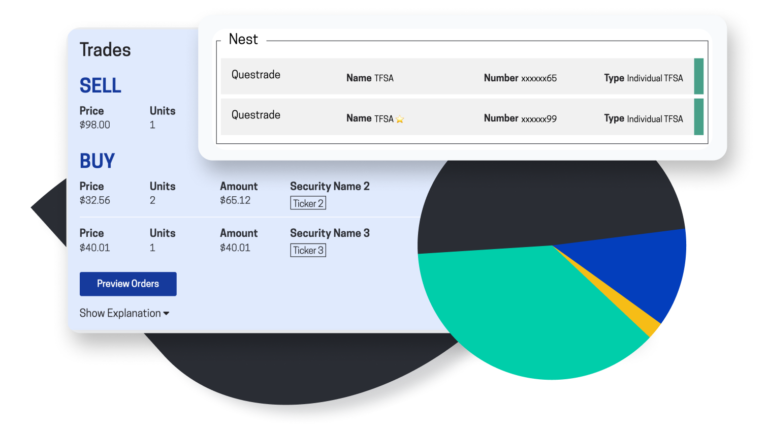

The primary product of Passiv is SnapTrade, an API that allows developers to connect retail brokerage accounts to their app. The connection provides real-time account data, historical transactions, and live trading for stocks, options, and cryptocurrencies.

“Over the past five years running our own B2C app, we’ve gained tremendous insight into the needs and challenges of developers who need connectivity to their end users’ trading accounts,” explains Brendan Lee Young, CEO of Passiv.

Passiv “turns your brokerage account into a modern portfolio management tool,” according to the company’s website. “Build your own personalized index, invest and rebalance with the click of a button, and seamlessly manage multiple accounts.”

“The ability to integrate with one API to support many brokerages is quite a compelling value proposition,” noted Mike Scanlin of Mistral Venture Partners.

“NBIF sees massive potential for the Passiv team and technology to make an impact in the fintech arena,” stated the organization’s director of investments, Peter Goggin. “Having single-source access to brokerage trading programs through the SnapTrade API, many benefits will become available to Passiv customers.”

“With growing interest in investing from retail investors, more tools to support successful and reliable trading will enable exciting capabilities for developers, investors, and brokerages alike,” added Goggin.

Passiv was founded in 2017 with the goal of making it easier for retail investors to invest and manage their wealth at retail brokerages and cryptocurrency exchanges.

Leave a Reply