Borrowell has launched a new way for consumers to understand and build credit through simply paying their rent.

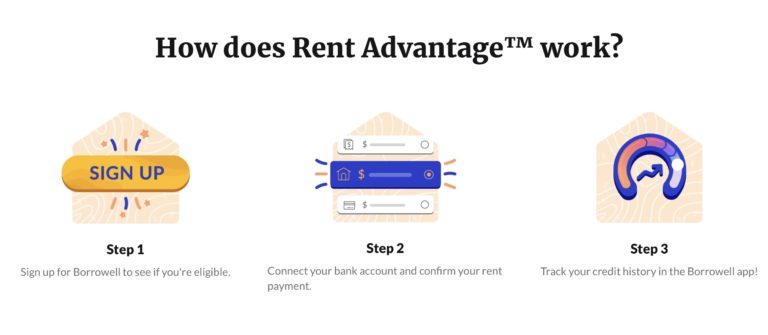

The Toronto-based financial technology firm’s new program, Rent Advantage, enables tenants to report monthly home rent payments to Canada’s largest consumer credit bureau, Equifax.

“Rent is often the largest expense Canadians have each month,” said Sandy Kyriakatos, Equifax Canada’s Chief Data Officer. “Recording payment history can give lenders a more accurate picture of a consumer so they can better understand the consumer’s credit-worthiness.”

The payment history on someone’s credit report is the largest factor in determining their credit score, which is an important factor considered by lenders to assess a borrower’s credit-worthiness. Consumers with lower credit scores may be less likely to qualify for credit cards, loans, and mortgages at competitive rates.

“We want to make the credit system work better for underserved Canadians,” said Andrew Graham, CEO of Borrowell. “This program was built with renters in mind and allows them to use payments they’re already making to build credit history so they may qualify for more financial products at better rates in the future.”

A survey conducted by Borrowell in June found that among respondents with credit scores of under 660, 68% were renters, a stark difference compared to the Canadian average of 32% of households identifying as renters, according to Statistics Canada.

“Tenants who demonstrate good payment behaviour should be able to benefit from those actions, the same way a homeowner paying a mortgage would—it’s only fair,” said Graham, who noted the program does not require involvement from a landlord.

Last year, Borrowell reached two million customers across Canada.

The startup’s Rent Advantage charges a monthly subscription fee of $5.

Leave a Reply