A Canadian financial technology startup has emerged from stealth following a Series A round of funding.

Toronto-based Pine, which was founded in 2021, has secured a total of $27 million across its Seed and Series A stages, the company announced today. The latest funding round was led by Greylock with participation from Inovia Capital, Intact Ventures, Global Founders Capital, Box Group, Ludlow Ventures, and Thomvest.

Pine is offering a new digital-first approach to Canadian mortgages. In Canada, currently upward of 90% of mortgages are tied to a major bank, something Pine hopes to change.

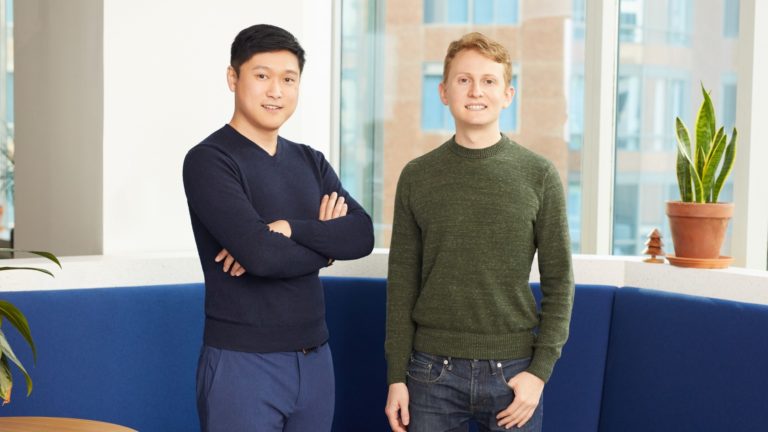

Founders Justin Herlick and Jonathan Shih believe that by eliminating unnecessary costs and lengthy processes that come with in-person applications, Pine can offer Canadians lower rates and a more efficient process than traditional banks do.

“The mortgage industry has been outdated for decades,” says Herlick, who hails from digital mortgage firm Blend, which also cites Greylock as an investor. “Canadians are desperate for a solution that doesn’t have them relying on one of the big banks.”

Working with a direct-to-consumer model, Pine says Canadians can “apply anytime, anywhere” in just 10 minutes exclusively online. They cover the entire process, from application to loan.

“We are excited to be officially launching an entirely new home financing option for Canadians,” said Herlick.

He adds that the model includes no negotiating, hidden fees, or closing costs. The lowest rate available is the first rate offered to consumers, according to Herlick.

“Homebuyers across Canada, particularly in its largest cities, have been faced with multiple challenges for years when it comes to buying or refinancing a home,” noted Seth Rosenberg, Investor at Greylock. “Pine not only makes the process easier, they’re also lowering barriers of entry for newcomers to the market, helping them realize their home-ownership dreams potentially years earlier than planned.”

Pine currently operates in Ontario and plans to launch across Canada soon.

Other Canadian fintechs in the space include Toronto’s Perch, whose Pathfinder tool offers an instant mortgage rate quote online, and Montreal’s Nesto, which last year raised $76 million for its online brokerage platform.

Leave a Reply