Slowly but surely over the past few decades, Canada has transitioned into a nation of oligopolies (industries that are dominated by just a few companies). This is evident in the telecommunications and airline industries where consumers only have a few companies to choose from. It’s also incredibly noticeable in the financial sector, where the five largest banks own a whopping 89% of the total market.

This transition has left consumers with very few options for financial services. Due to this, Canadians have become incredibly reliant and loyal to their preferred financial institution. However, it finally appears as though this forced reliance and loyalty is beginning to shift again.

Let’s take a quick look at why the bundled financial services era in Canada is over.

The consolidation of the banking industry

The attentive consumer might have noticed that the phrase “banking industry” has slowly been phased out over the past few decades and replaced with “financial services industry”. This is mainly due to the fact that there has been a flurry of consolidation in the banking industry, starting in the 1990s. During this time, the country’s biggest banks started buying up insurance companies, brokers, asset managers, and other companies in order to expand their offerings to clients.

This consolidation continued after Canada safely navigated the Financial Crisis of 2008. Due to their success here, Canada’s system of big banks was heralded as one of the safest in the world. This served as a testament for big banks and lead to even more mergers and acquisitions in the financial services industry.

Today, there are really just five major players in the banking industry:

- Bank of Montreal (BMO)

- Bank of Nova Scotia (Scotiabank)

- Canadian Imperial Bank of Commerce (CIBC)

- Royal Bank of Canada (RBC)

- Toronto-Dominion (TD)

Even though these banks consolidated in order to offer more services to consumers, the fact that there are only five banks to choose from greatly stifles competition. Since there are no other options, Canadians grew to rely on these banks for just about every financial service.

However, this era of bundled financial services is finally starting to shift toward an era of self-service.

The self-service takeover

In recent years, a tremendous number of financial service startups have cropped up in hopes of offering better service to consumers. By leveraging digital tools, new fintech companies are finally starting to offer better financial tools to consumers who have been stuck with the same five banks for years.

A few examples are the creation of robo-advisors (Wealthsimple), better ways to spend/save (Koho), and even powerful product comparison tools. These new tools offer consumers things like better interest rates on their deposits, a better user experience, and transparent reviews of existing products.

Even if they stay with one of the big five players, consumers can easily get access to information that used to be difficult to find. For example, at the click of a button, you can instantly get answers to questions like:

- Which savings account pays the most interest?

- Which chequing account has the lowest fees?

- Which brokerage account has the best research tools?

- Which credit card offers the most rewards points?

This access to information is ushering in a new era of financial transparency where consumers have more power over which financial products they want to use.

Big banks have responded by attempting to mimic these products. However, the damage has already been done and consumer loyalty has shifted.

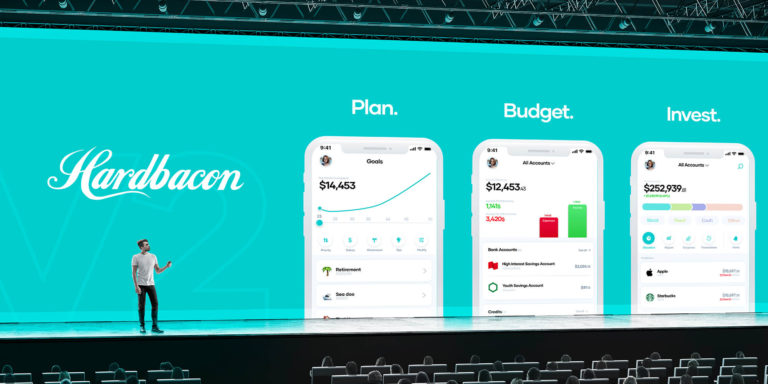

Additionally, if the Canadian government is successful in imitating Europe’s open banking policies, then this trend will continue to accelerate. As a result of these policies, users will be able to move their data more easily to a competitor, or to third-party apps like Hardbacon.

The future of financial services in Canada

Canadians have traditionally been incredibly loyal to their bank, with over 91% of consumers trusting their bank to handle their personal information more than other companies. However, this could easily be attributed to the fact that there have been almost no alternatives for consumers.

Now that Canadians can get access to better financial products as well as pick and choose which product is best for them, there’s no reason for consumers to remain blindly loyal to just one financial institution.

Julien Brault is the CEO of Hardbacon.

Leave a Reply