Vancouver fintech Mogo (TSX:MOGO) is acquiring Montreal’s Moka Financial Technologies, one of Canada’s leading saving and investing apps, in an all-stock transaction.

The proposed acquisition will increase Mogo’s member base by over 40% to more than 1.7 million and expand Mogo’s wealth offering to include saving and investing products.

In addition, the acquisition will accelerate Mogo’s plan to launch a free stock trading solution for Canadians which will further solidify Mogo’s position as the most comprehensive digital wallet in Canada. The two companies expect to complete a definitive agreement and close the transaction in Q2 2021.

Montreal-based Moka launched in 2017 with the social mission to help millennials achieve their financial goals, and it has since been downloaded by over 1 million consumers. Moka currently has more than 500,000 active members and over 100,000 monthly subscription members, and the company generated approximately $6.5 million of revenue in 2020.

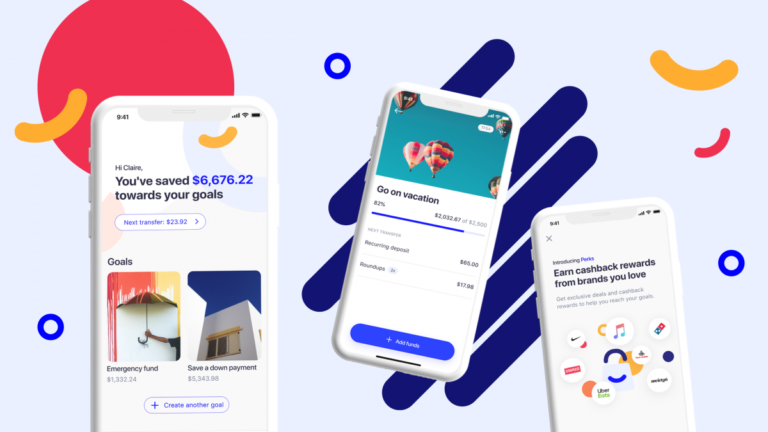

The Moka app has become one of Canada’s most popular investing apps due to its roundup feature, which automatically rounds up daily purchases and invests the spare change in personalized, diversified portfolios of low-cost Exchange-Traded Funds. Moka members can invest through a TFSA, RRSP or non-registered account.

“This acquisition represents another significant milestone for Mogo on our journey to building the leading digital wallet for Canadians,” said David Feller, Mogo’s Founder and CEO.

“Like Mogo, Moka is driven to help users improve their financial health, and they have built an innovative solution to enable consumers to easily save and invest money. By adding these digital saving and investing products – along with Moka’s technology platform and experienced fintech team – we will dramatically enhance what is already one of the most compelling and differentiated value propositions in Canadian finance. Moka will complement our existing MogoCrypto account and form the core of MogoWealth, making Mogo’s digital wallet the most comprehensive solution in Canada.”

Leave a Reply