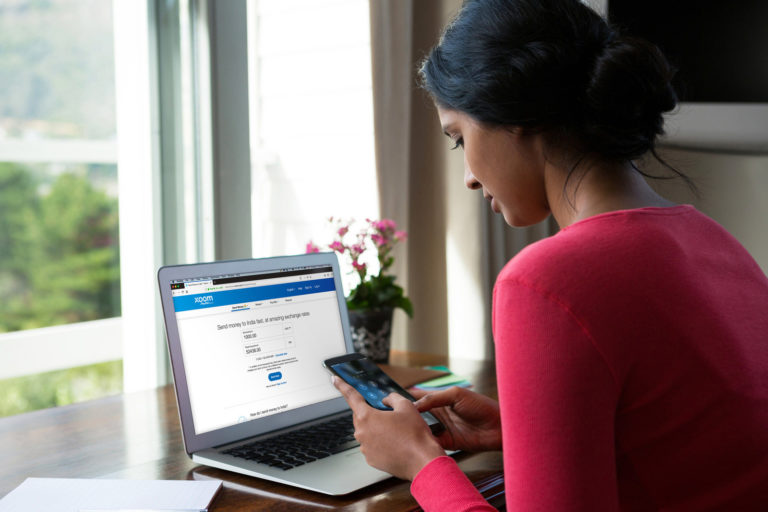

Today, PayPal launched Xoom, its international money transfer service in Canada.

Canadians can now use Xoom to send money, pay bills or reload phones fast to more than 130 countries internationally at competitive rates.

The global remittance market is an estimated $600 billion industry with Canadians remitting nearly $24 billion annually. Canada is one of the world’s most diverse countries and is home to nearly 7.5 million foreign-born people from more than 200 places of birth.

With this launch, PayPal and Xoom are helping improve the financial health of Canadians and millions of people worldwide.

Introducing Xoom will benefit more than one in five people living in Canada – many of whom support family members overseas for things like medical bills, education, utility bills, and other financial needs.

Historically, the cost of securely and efficiently managing and moving money across borders has been high, but advances in digital technology—in particular mobile—are enabling a significant reduction in remittances costs.

Sending money overseas through a digital service like Xoom costs nearly half (3.93%) of the amount sent compared to the average cost of traditional remittances services (7.45%).

Leave a Reply